It’s no wonder the search for the best cash back credit cards is in such demand. Cash back is the simplest form of a credit card loyalty program. Unlike with miles or points, there is no uncertainty about the value of your rewards. And since the value is fixed, no advanced redemption strategies are required either.

Another benefit of a cash back card is the low entry barrier. Advanced loyalty programs and travel cards ask for hefty annual fees and require excellent credit, above average income, and a specific lifestyle. Cash back credit cards are justified for just about any lifestyle and level of income. They are also not so hard on your credit history, although an above average score is expected.

Top cash back credit cards

About the only challenge of a cash back card is selecting the right one. They vary by complexity, reward categories, sign-up bonuses, spending caps, and some other minor features. While there is no single winner, there are cash back credit cards that are best for specific consumer habits. So, in selecting a cash back loyalty program, you should look at whether or not it matches your current lifestyle.

- Best for flat-rate rewards: Citi® Double Cash Card

The most laid-back option, earning 2% on all purchases at no additional cost - Flat-rate runner-up: Chase Freedom® Unlimited

Earns valuable Ultimate Rewards® points, although at a lesser rate of 1.5% - Flat-rate runner-up: Capital One® Quicksilver® Cash Rewards Credit Card

Also a lesser rate of 1.5%, but no foreign transaction fees - Best for supermarkets: Blue Cash Preferred® Card from American Express

Big earner in the supermarket category, with above average sign-up bonus - Best for foodies: Capital One® Savor® Cash Rewards Credit Card

Unlimited 3% return on restaurants and no annual fee - Best for rotating categories: Discover it® Cash Back

Up to 5% on rotating categories and all cash back is doubled at the end of the first year - Rotating category runner-up: Chase Freedom® credit card

Up to 5% on rotating categories, with a sign-up bonus and no annual fee - Rotating category runner-up: U.S. Bank Cash+™ Visa Signature®

Pick your own bonus categories, sign-up bonus, no annual fee - Best for weak credit: Capital One® QuicksilverOne® Rewards

Relaxed credit requirements and a flat rate of 1.5%

Citi® Double Cash Card

- You earn unlimited 2% cash back on all purchases. This offer is currently unmatched by any other flat-rate card we’ve looked at. There is also $0 annual fee, an 18-month, no-APR period for a balance transfer, and you are given a pass on your first late payment. Another thing we are considering to be a benefit is the timing of cash back. You are given 1% upon making a purchase, and then another 1% upon paying your balance – some useful motivation for practicing responsible financial behavior.

- You can redeem the rewards in $25 increments only.

IN SUMMARY

- Best suited for users who seek simplicity. No need to worry about tiered rates or any other conditions. Just whip it out wherever and get 2% return no matter what. Use it on a daily basis for all of your purchases. Alternatively, use it in combination with other cash back cards to pay for categories where they fall short.

Chase Freedom® Unlimited credit card

- Rewards are earned at a flat rate of 1.5% and there is no spending cap. The unique thing is that you actually earn Ultimate Rewards® points instead of straight-up cash back. The points can be easily converted to cash back. They can also be transferred to Chase travel partners and used to book flights. Should you feel like trying, travel redemption might be much more profitable than cash back redemption. There is also no annual fee, no limit on how much can be redeemed, an introductory bonus of $150, and an additional bonus of $25 for the first authorized user added within the first 3 months.

- Apart from the obvious fact that the rewards rate is lower than that of the Citi® Double Cash Card, there is also the Chase 5/24 rule. If you’ve had more than five cards, from any bank, opened in the last 24 months, you will not be approved for a new one from Chase.

IN SUMMARY

- Falls short of the Citi® Double Cash Card in terms of the rewards rate, but makes it up with a higher introductory bonus. The option to redeem points for flights is a nice-to-have, for when you decide to explore free travel, but is not strictly an advantage.

Capital One® Quicksilver® Cash Rewards Credit Card

- There is an introductory bonus of $150, no annual fee, no limit on how much cash back you can earn, and no limit on how much and when can be redeemed. The rate is 1.5%, no tiers. There is also no foreign transaction fee – a rare feature among cash back credit cards.

- The rewards rate is lower than what you get with the Citi® Double Cash Card.

IN SUMMARY

- It earns rewards at a reasonable rate, yet falls short of both the Citi® Double Cash Card and the Chase Freedom® Unlimited. We’d say that the only case for this card is if you are planning to use it abroad. Foreign transaction fees are about 3%, and you can save more by not paying transaction fees than by earning rewards.

Blue Cash Preferred® Card from American Express

- You are offered higher rewards rates in fixed bonus categories: supermarkets (6%) and gas stations (3%), and a flat rate of 1% for any other purchases. That’s the highest rewards rate we’ve got on our list. It also has the highest sign-up bonus of $250, achieved by spending $1,000 within the first 3 months.

- There is an annual cap on the supermarket bonus category. Each year, you’ll earn 6% back on the first $6,000 spent in supermarkets. After that, the rate will drop to 1% for the remainder of the year. There is also has an annual fee of $95 and a minimum redemption amount of $25.

IN SUMMARY

- An ideal loyalty program for a family or anyone doing a large share of their spending at a supermarket. If you max out on this category alone, you’ll earn $360 in rewards – well in excess of the annual fee. And that’s before we account for gas and everything else. Read full review.

Capital One® Savor® Rewards Credit Card

- You are offered a fixed bonus rate on dining and entertainment (4%), groceries (2%), and a flat rate of 1% on everything else. The good news? There is an introductory bonus of $500, no annual fee, and no cap on bonus rates.

- If you don’t spend a ton of money going out, then you are better off going with any of the other cash back credit cards on the list.

IN SUMMARY

- If you are a committed foodie, then this card should have a prime spot in your wallet. If not, get it anyway and keep it around for when you are going out. There is no annual fee, so it doesn’t cost you anything to maintain this card along with some other ones that might be earning more in different categories.

Discover it® Cash Back

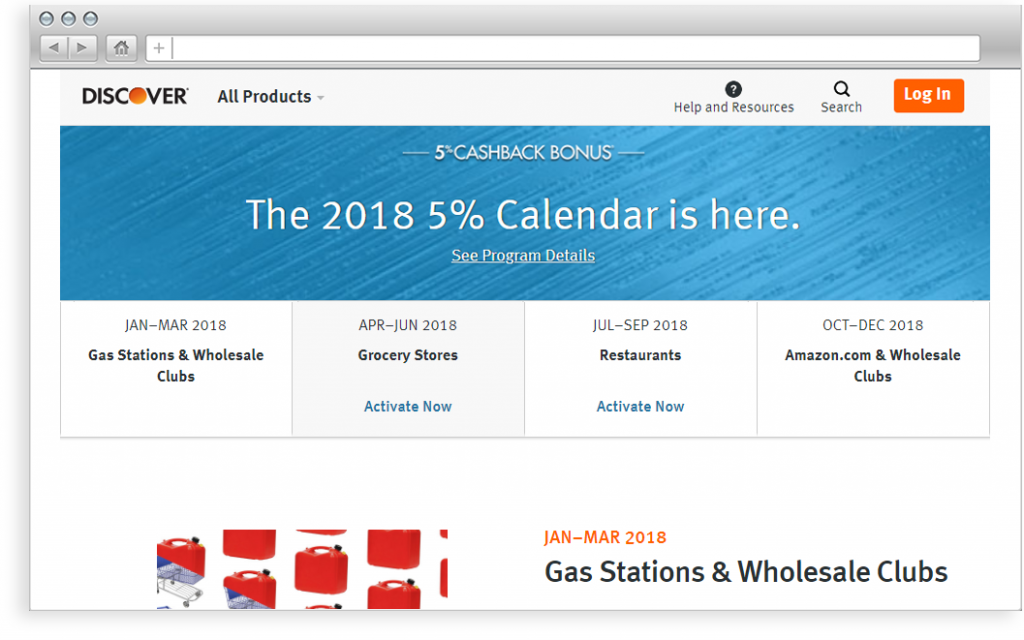

- The Discover it® Cash Back has rotating bonus categories. There is a new category each quarter for which the rewards rate is 5%. For everything else, the rate is 1%. The most unique feature of this loyalty program is the cash back match. At the end of the first year, the Discover matches all of the cash back you’ve earned, which could be upwards of $300. There is also no annual fee, no foreign exchange fees, and the fee is waived on your first late payment.

- There is a cap on bonus categories. Each quarter, you’ll earn 5% back on the first $1,500 spent within the bonus category. After that, the rate will drop to 1% for the remainder of the quarter. There is no sign-up bonus offer. You might also struggle to earn maximum rewards in each quarter, since some of them might not match your lifestyle.

*The Discover bonus categories for 2018. Click here to visit the source page.

IN SUMMARY

- The cash back match is a powerful and unique feature that could be worth twice as much as the average sign-up bonus. While the rest of the features are comparable to other rotating bonus category cards, the cash back match makes it a clear winner.

Chase Freedom® credit card

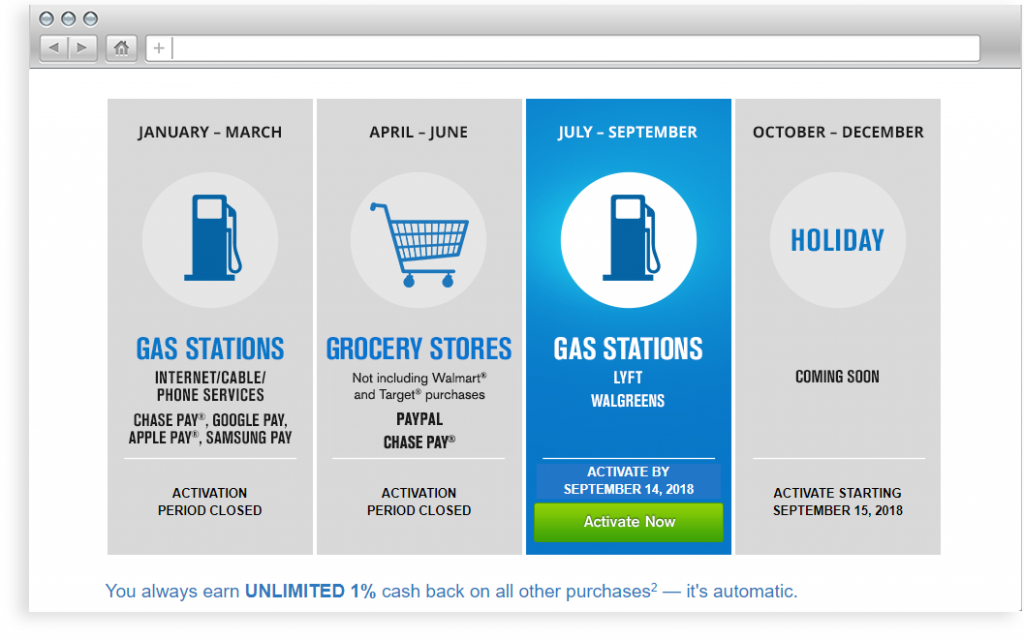

- Another 5% rotating category card, only this time with a sign-up bonus. You’ll earn a $150 bonus if you manage to make $500 in purchases within the first 3 months. Don’t forget that with Chase, you earn Ultimate Rewards® points instead of just cash. While you can easily convert any amount of them to statement credit, you can also transfer points to Chase travel partners and use them to book flights. Just an option, if you ever need it.

- There is a spending limit for the bonus category. Each quarter, after you’ve spent $1,500 on the bonus category, your rewards rate goes from 5% to 1%. Also, some of the categories might not fit your spending habits, so you are not guaranteed to hit maximum rewards every quarter.

*The Chase Freedom® bonus categories for 2018.

IN SUMMARY

- With a sign-up bonus and an authorized user bonus, it’s not that far behind the Discover it® Cash Back. Since there is no annual fee on either of those, we’d suggest to keep both. This way, you’d be able to cover a broader range of bonus categories. And even if the categories match for the quarter, you’d still benefit from having a combined spending cap of $3,000 instead of $1,500.

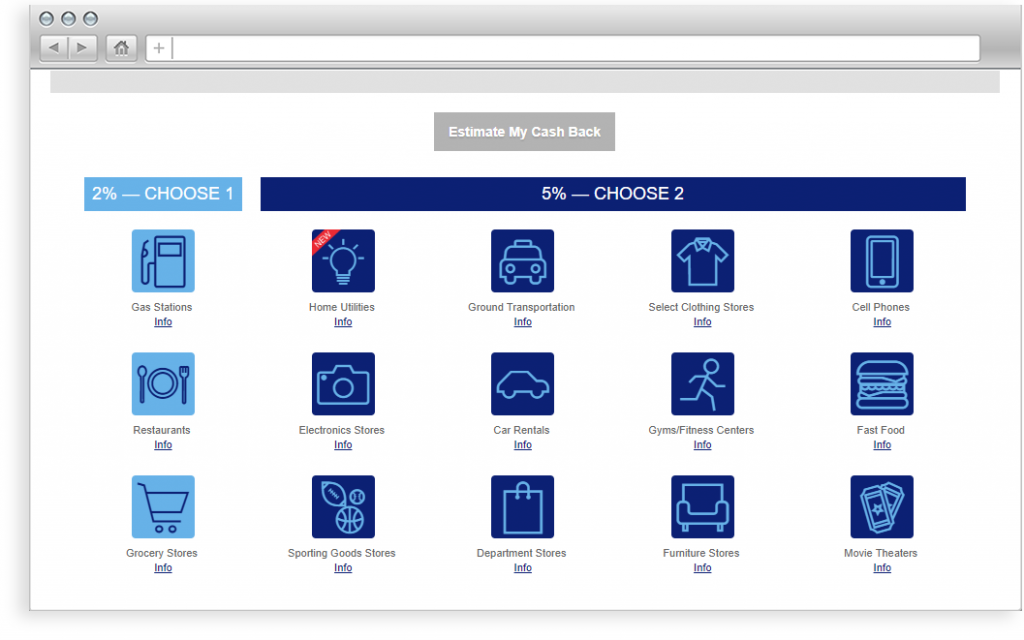

U.S. Bank Cash+™ Visa Signature® Card

- You have a chance to select your own bonus categories. Each quarter, you get to choose two bonus categories for earning rewards at a 5% rate and one for earning 2%. The rate on all other purchases is 1%. On top of that, you get an above average spending limit. The cap for 5% categories is $2,000 per quarter. There is also no annual fee and the usual sign-up bonus of $150.

- If you take a closer look at the current 5% categories, you’ll see that it’s unlikely you’ll have consistently high spending in any of them. And the best earners are actually in the 2% category, where you can pick only one per quarter. This distribution makes it challenging to push the rewards to their full potential.

*U.S. Bank bonus categories as of June, 2018. Click here to visit the source page.

IN SUMMARY

- A potentially great earner, with flexible rewards, but a poor selection of reward categories. However, if you are willing to extend a little more effort planning your purchases, and are actually spending enough in the 5% categories, then the flexibility alone might raise this card above its competition.

Capital One® QuicksilverOne® Rewards

- Its greatest strength is its lower than usual credit requirement. It is claimed that the card accepts average credit scores, though no exact range is specified. Once approved, you’ll enjoy a flat rate of 1.5% on all purchases, which is a good deal, considering that the cards for poor credit tend to not have any benefits at all.

- There is an annual fee of $$39 and no sign-up bonus offer.

IN SUMMARY

- While not as attractive as its competition, Capital One® QuicksilverOne® Rewards could be your segway into the world of credit card rewards. Use it until your credit has improved, and then ditch it for a better one. As to the annual fee, it should be no problem if you spend $50 or more per week on purchases.

What are the different cash back card types?

While we can think of a few ways to split cash back credit cards into types, we believe that the most appropriate one is according to complexity.

Simple: flat-rate cash back

Flat rate is when you get the same rate of return on all purchases. The rate is usually between 1.5% and 2%. Now, other cards may have higher rates in select categories and then lower rates on other purchases. That would give you the opportunity to earn more rewards. That would also require more effort in monitoring the categories, managing your expenses, and juggling several cards at once. With a flat rate, you can forgo all of that and enjoy a single card and a single rate.

Somewhat simple: bonus category cash back

Here you have a base rate of 1% on all purchases and a couple of fixed categories where you can earn between 2% and 6%. The categories are usually from the big ones, like gas, groceries, or dining. The spending for bonus categories is usually capped at $5,000-6,000 per year, after which you go back to the base rate of 1%.

Those rates seem like a better deal than the flat rates. After all, the categories are fixed, and there is nothing to monitor, so there is not much extra complexity. While that’s true, with those cards your spending has to be weighted significantly towards those specific bonus categories. If you do not spend enough in them, then you are earning the base rate of 1% – and that’s worse than the 2% you would have earned with a flat rate.

Complicated: rotating bonus category cash back

You get the same base rate of 1% on all purchases and then a couple of rotating bonus categories that earn up to 5% cash back. Rotating categories change each quarter, and usually include a couple of big ones, like gas or groceries, and a couple of odd ones, like home improvement stores and movie theatres. There is also a cap on bonus categories of between $1,500 and $2,000 per quarter.

The challenge is obvious – you have to keep track and you probably have to have a couple of different cash back credit cards to cover more bonus categories at all times. That means some kind of management system has to be employed. Some people use an app, a spreadsheet, or even a printout that you keep in your wallet. If you are ready to go to that length, then you are looking at having close to 5% returns nearly all the time. The only question is whether it’s worth the effort.

How to pick the best cash back credit cards?

When looking for the best cash back credit cards, there are a couple of considerations to be made on top of what type they are.

Consider your spending habits

If you are getting into a loyalty program that benefits specific spending categories, then it’s important those categories match your actual lifestyle. First, it will deliver more rewards. And second, you’ll avoid unnecessary spending. Because it’s all too easy to get a card that rewards going out and then find yourself going out quite a bit more and end up wasting more than you’re earning.

If you are getting into a loyalty program that benefits specific spending categories, then it’s important those categories match your actual lifestyle. First, it will deliver more rewards. And second, you’ll avoid unnecessary spending. Because it’s all too easy to get a card that rewards going out and then find yourself going out quite a bit more and end up wasting more than you’re earning.

Calculate the return

![]() Are you better off with a flat rate of 2% or a tiered rate that offers 3% on groceries, 2% on gas, and 1% on everything else? It looks close, but the only way to know for sure is to sit down, approximate your expenses, and calculate the return for each one. Don’t forget to include annual fees, sign-up bonuses, and spending limits.

Are you better off with a flat rate of 2% or a tiered rate that offers 3% on groceries, 2% on gas, and 1% on everything else? It looks close, but the only way to know for sure is to sit down, approximate your expenses, and calculate the return for each one. Don’t forget to include annual fees, sign-up bonuses, and spending limits.

Rewards are earned on eligible expenses only. It means no fees, bets, cash withdrawals, and other cash-like transactions. Statistically, only about a third of one’s total living expenses are eligible for earning rewards.

Check the redemption policy

![]() Some loyalty programs allow you to redeem the rewards in any amount and at any time. Others have a redemption threshold and you can’t redeem until you’ve accumulated a certain amount of rewards. This is not necessarily a deal breaker, but make sure to learn about those policies in advance in case they make you uncomfortable.

Some loyalty programs allow you to redeem the rewards in any amount and at any time. Others have a redemption threshold and you can’t redeem until you’ve accumulated a certain amount of rewards. This is not necessarily a deal breaker, but make sure to learn about those policies in advance in case they make you uncomfortable.

Currently, Wells Fargo, Citi, and American Express have a “minimum to redeem” policy, while Chase, Capital One, Discover, and U.S. Bank do not.

Don’t mind the interest rates

![]() While the cards vary in their interest rates and the duration of the no-APR introductory periods, we do not make it a part of our analysis. The reason is that the rewards cards are not meant to carry a balance – the interest would cancel out any of the benefits you earn. Yes, we do mention the no-APR period here and there, and, if you absolutely must use it to, say, pay off a bigger purchase, then go ahead and do so responsibly. But you should not plan to carry a balance beyond that.

While the cards vary in their interest rates and the duration of the no-APR introductory periods, we do not make it a part of our analysis. The reason is that the rewards cards are not meant to carry a balance – the interest would cancel out any of the benefits you earn. Yes, we do mention the no-APR period here and there, and, if you absolutely must use it to, say, pay off a bigger purchase, then go ahead and do so responsibly. But you should not plan to carry a balance beyond that.

Remember the 5/24 rule

![]() If you are planning on getting more than one card, then you should probably start with either one of the Chase cards. Otherwise, you might have to wait for your card opening history to clear before Chase approves you for a new one.

If you are planning on getting more than one card, then you should probably start with either one of the Chase cards. Otherwise, you might have to wait for your card opening history to clear before Chase approves you for a new one.

How to maximize cash back rewards?

By getting the best cash back credit cards, obviously, but there also are a few extra things you might try.

Go for the intro bonus

![]() Sign-up bonuses range from $100 to $200. It would have taken you between $2,000 and $10,000 of spending to earn the same amount of cash back. Clearly, getting that bonus should be a part of your strategy. So don’t open too many cards at once, and make sure you have enough of naturally-occuring spending to earn the bonus on each one you open.

Sign-up bonuses range from $100 to $200. It would have taken you between $2,000 and $10,000 of spending to earn the same amount of cash back. Clearly, getting that bonus should be a part of your strategy. So don’t open too many cards at once, and make sure you have enough of naturally-occuring spending to earn the bonus on each one you open.

Beware of merchant codes

![]() While it is advertised that you get higher rewards rates for specific categories, like groceries, it does not mean that you will qualify by buying groceries from any store or even any grocery store. You’ll only get the bonus if the store has the appropriate merchant code. Those are the codes under which each store is registered in the credit card system. And the catch is – sometimes those codes don’t make sense.

While it is advertised that you get higher rewards rates for specific categories, like groceries, it does not mean that you will qualify by buying groceries from any store or even any grocery store. You’ll only get the bonus if the store has the appropriate merchant code. Those are the codes under which each store is registered in the credit card system. And the catch is – sometimes those codes don’t make sense.

Sometimes an odd 7-Eleven would be registered as a gas station, and sometimes a gas station would be registered as a grocery store. So you have to be aware of merchant codes to make sure your purchases land in the right category. And the best way to be aware of merchant codes is to look at your purchase history and check which purchases got what bonuses.

No need to obsess over it – just keep an eye out for irregularities and make sure you don’t consistently shop at a place that should be in a bonus category, but is not.

Use gift cards

![]() Let’s say there is a bonus category that offers good rewards rates, but you don’t shop there enough. A good way to trick the system is to check whether those stores carry gift cards for places where you do shop. Technically, you’d still be shopping within the bonus category, but actually buying credit for shopping at other places.

Let’s say there is a bonus category that offers good rewards rates, but you don’t shop there enough. A good way to trick the system is to check whether those stores carry gift cards for places where you do shop. Technically, you’d still be shopping within the bonus category, but actually buying credit for shopping at other places.

Combine several cards

![]() What do you do when your rotating category card has a home improvement bonus for the next quarter and there is nothing you need from a home improvement store? Don’t earn any rewards? That’s crazy! That’s why you get a couple of different cash back credit cards, allowing you to earn at least some kind of bonus at all times. And why not – most of them have no annual fee anyway.

What do you do when your rotating category card has a home improvement bonus for the next quarter and there is nothing you need from a home improvement store? Don’t earn any rewards? That’s crazy! That’s why you get a couple of different cash back credit cards, allowing you to earn at least some kind of bonus at all times. And why not – most of them have no annual fee anyway.

As an example, we’d get at least two rotating category cards and definitely the Citi® Double Cash Card for when no bonus category is at play.

Check out credit card shopping portals

![]() Some credit card companies keep their own online shopping portals. There they offer discounts and rewards rates that are not available elsewhere. On the Discover® portal, for example, there are deals available offering up to 10% cash back. Just imagine using the Discover it® Cash Back to earn 10% cash back, and then have it doubled at the end of the first year. That’s 20% return. Insane! Now, most deals up there are not as attractive, but it’s still a good way to expand your range of bonus-earning purchases.

Some credit card companies keep their own online shopping portals. There they offer discounts and rewards rates that are not available elsewhere. On the Discover® portal, for example, there are deals available offering up to 10% cash back. Just imagine using the Discover it® Cash Back to earn 10% cash back, and then have it doubled at the end of the first year. That’s 20% return. Insane! Now, most deals up there are not as attractive, but it’s still a good way to expand your range of bonus-earning purchases.

The bottom line

The good thing about cash back credit cards is that there is a wide range of options and a good match can be found for any lifestyle and personality type. There are effortless flat-rate cards for an ease of mind, intensive rotating category cards for diligent saving, and fixed category cards for somewhere in-between. And once you consider all of the available combinations and maximization strategies, the possibilities become… well, not endless, but certainly enough to keep you occupied for a while. Use our guide to make the right choice of the best cash back credit cards, and good luck!